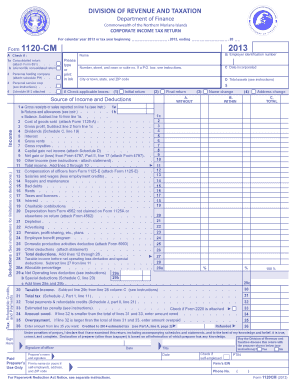

WebS Corporation 1120S Return Due Date. Recapture of Indian employment credit. Attach a separate Form 1122 for each new subsidiary being included in the consolidated return. Scientific equipment used for research to institutions of higher learning or to certain scientific research organizations (other than by personal holding companies and service organizations). Deferred tax on the corporation's share of undistributed earnings of a qualified electing fund. Supplies used and consumed in the business. Certain costs of a qualified film, television, or live theatrical production commencing before January 1, 2026 (after December 31, 2015, and before January 1, 2026, for a live theatrical production). In general, the deduction under section 245(b) applies to dividends paid out of the earnings and profits of a foreign corporation for a tax year during which: All of its outstanding stock is directly or indirectly owned by the domestic corporation receiving the dividends, and. See the Instructions for Form 1139. If this is the corporation's final return and it will no longer exist, check the Final return box. 535 for details on other deductions that may apply to corporations.  Applicable corporations (within the meaning of section 59(k)) may be required to pay this AMT. However, the deduction is not disallowed to the extent the amount is directly or indirectly included in income in the United States, such as if the amount is taken into account with respect to a U.S. shareholder under section 951(a) or section 951A. The amount included in income from Form 8864, Biodiesel, Renewable Diesel, or Sustainable Aviation Fuels Credit. The uniform capitalization rules of section 263A require corporations to capitalize certain costs to inventory or other property. Attach a statement to Form 1120 showing how the amount on line 3, column (c), was figured. Web2023 Filing Season Extended Return Deadline: Monday, October 2, 2023 (Monday, October 16 for a bankruptcy estate return) Form 1120, 1120-C, and 1120-H. Standard Due Date: See Regulations section 1.263(a)-3(n) for information on how to make the election. Attach a declaration to the return stating that the resolution authorizing the contributions was adopted by the board of directors during the tax year. See sections 163(e)(3) and 267(a)(2) for limitations on deductions for unpaid interest and expenses. However, see exceptions discussed later. Generally, the corporation can deduct only 50% of the amount otherwise allowable for non-entertainment related meal expenses paid or incurred in its trade or business. Attach a statement, listing by type and amount, all allowable deductions that are not deductible elsewhere on Form 1120. Once made, the election is irrevocable. Trusts and Estates: Filing an income tax return for the 2022 calendar year (Form 1041) or filing for an automatic five-and-a-half month extension to October 1 (Form 7004), and paying any income tax due. See the March 2022 revision of the Instructions for Form 941 and the 2022 Instructions for Form 944 for more information. Any net operating loss (NOL) carryback to the tax year under section 172. More detailed information by jurisdiction is included below: FEDERAL [table id=7 /] DISTRICT OF COLUMBIA [table id=8 /] MARYLAND [table id=6 /] VIRGINIA As a taxpayer, the corporation has rights that the IRS must abide by in its dealings with the corporation. Ready or not, Tax Day is quickly approaching. See section 168(g)(1)(F). A corporation filing Form 1120 that is not required to file Schedule M-3 may voluntarily file Schedule M-3 instead of Schedule M-1. WebThe 2022 tax brackets for people filing individual returns in 2023 are: 37% for incomes greater than $539,900. See section 163(e)(5) to determine the amount of the deduction for OID that is deferred and the amount that is disallowed on a high yield discount obligation. File supporting statements for each corporation included in the consolidated return. See section 4682(g)(2). See section 7874(a). Lobbying expenses. If the corporation has changed its address since it last filed a return (including a change to an in care of address), check the Address change box. Enter any alternative tax on qualifying shipping activities from Form 8902. Include any of the following taxes and interest. 15 (Circular E), Employer's Tax Guide, or Pub. Enter T and the amount on the dotted line next to the entry space. The average burden for partnerships filing Forms 1065 and related attachments is about 85 hours and $3,900; the average burden for corporations filing Form 1120 and associated forms is about 140 hours and $6,100; and the average burden for Forms 1066, 1120-REIT, 1120-RIC, 1120S, and all related attachments is 80 hours and $3,100. Special Returns for Amounts paid to produce or improve property must be capitalized. The Form 1120 tax return, used by corporations, is due, and taxes are payable on the 15th day of the fourth month after the end of the company's fiscal year. Tax Day is Tuesday, April 18, this year, the annual day when individual income tax returns are due to be submitted to the federal government. Enter the foreign-source portion of any subpart F inclusions attributable to the sale or exchange by a CFC of stock in another foreign corporation described in section 964(e)(4). A significant distributee (as defined in Regulations section 1.355-5(c)) that receives stock or securities of a controlled corporation must include the statement required by Regulations section 1.355-5(b) on or with its return for the year of receipt. April 18 C-CorporationsFile a 2022 calendar year income tax return (Form 1120) and pay any tax due. Complete item 12 on Schedule K. If an ownership change (described in section 382(g)) occurs, the amount of the taxable income of a loss corporation that may be offset by the pre-change NOL carryovers may be limited. Enter the amount of the NOL carryover to the tax year from prior years, even if some of the loss is used to offset income on this return. Penalties may also apply under section 6707A if the corporation fails to file Form 8886 with its corporate return, fails to provide a copy of Form 8886 to the Office of Tax Shelter Analysis (OTSA), or files a form that fails to include all the information required (or includes incorrect information). If the due date falls on a Saturday, Sunday, or legal holiday, the corporation can file on the next business day. Note: If you are a cooperative, Form IL-1120 is due on the 15th day of the 9th month following the close of the tax year regardless of when your tax year ends.

Applicable corporations (within the meaning of section 59(k)) may be required to pay this AMT. However, the deduction is not disallowed to the extent the amount is directly or indirectly included in income in the United States, such as if the amount is taken into account with respect to a U.S. shareholder under section 951(a) or section 951A. The amount included in income from Form 8864, Biodiesel, Renewable Diesel, or Sustainable Aviation Fuels Credit. The uniform capitalization rules of section 263A require corporations to capitalize certain costs to inventory or other property. Attach a statement to Form 1120 showing how the amount on line 3, column (c), was figured. Web2023 Filing Season Extended Return Deadline: Monday, October 2, 2023 (Monday, October 16 for a bankruptcy estate return) Form 1120, 1120-C, and 1120-H. Standard Due Date: See Regulations section 1.263(a)-3(n) for information on how to make the election. Attach a declaration to the return stating that the resolution authorizing the contributions was adopted by the board of directors during the tax year. See sections 163(e)(3) and 267(a)(2) for limitations on deductions for unpaid interest and expenses. However, see exceptions discussed later. Generally, the corporation can deduct only 50% of the amount otherwise allowable for non-entertainment related meal expenses paid or incurred in its trade or business. Attach a statement, listing by type and amount, all allowable deductions that are not deductible elsewhere on Form 1120. Once made, the election is irrevocable. Trusts and Estates: Filing an income tax return for the 2022 calendar year (Form 1041) or filing for an automatic five-and-a-half month extension to October 1 (Form 7004), and paying any income tax due. See the March 2022 revision of the Instructions for Form 941 and the 2022 Instructions for Form 944 for more information. Any net operating loss (NOL) carryback to the tax year under section 172. More detailed information by jurisdiction is included below: FEDERAL [table id=7 /] DISTRICT OF COLUMBIA [table id=8 /] MARYLAND [table id=6 /] VIRGINIA As a taxpayer, the corporation has rights that the IRS must abide by in its dealings with the corporation. Ready or not, Tax Day is quickly approaching. See section 168(g)(1)(F). A corporation filing Form 1120 that is not required to file Schedule M-3 may voluntarily file Schedule M-3 instead of Schedule M-1. WebThe 2022 tax brackets for people filing individual returns in 2023 are: 37% for incomes greater than $539,900. See section 163(e)(5) to determine the amount of the deduction for OID that is deferred and the amount that is disallowed on a high yield discount obligation. File supporting statements for each corporation included in the consolidated return. See section 4682(g)(2). See section 7874(a). Lobbying expenses. If the corporation has changed its address since it last filed a return (including a change to an in care of address), check the Address change box. Enter any alternative tax on qualifying shipping activities from Form 8902. Include any of the following taxes and interest. 15 (Circular E), Employer's Tax Guide, or Pub. Enter T and the amount on the dotted line next to the entry space. The average burden for partnerships filing Forms 1065 and related attachments is about 85 hours and $3,900; the average burden for corporations filing Form 1120 and associated forms is about 140 hours and $6,100; and the average burden for Forms 1066, 1120-REIT, 1120-RIC, 1120S, and all related attachments is 80 hours and $3,100. Special Returns for Amounts paid to produce or improve property must be capitalized. The Form 1120 tax return, used by corporations, is due, and taxes are payable on the 15th day of the fourth month after the end of the company's fiscal year. Tax Day is Tuesday, April 18, this year, the annual day when individual income tax returns are due to be submitted to the federal government. Enter the foreign-source portion of any subpart F inclusions attributable to the sale or exchange by a CFC of stock in another foreign corporation described in section 964(e)(4). A significant distributee (as defined in Regulations section 1.355-5(c)) that receives stock or securities of a controlled corporation must include the statement required by Regulations section 1.355-5(b) on or with its return for the year of receipt. April 18 C-CorporationsFile a 2022 calendar year income tax return (Form 1120) and pay any tax due. Complete item 12 on Schedule K. If an ownership change (described in section 382(g)) occurs, the amount of the taxable income of a loss corporation that may be offset by the pre-change NOL carryovers may be limited. Enter the amount of the NOL carryover to the tax year from prior years, even if some of the loss is used to offset income on this return. Penalties may also apply under section 6707A if the corporation fails to file Form 8886 with its corporate return, fails to provide a copy of Form 8886 to the Office of Tax Shelter Analysis (OTSA), or files a form that fails to include all the information required (or includes incorrect information). If the due date falls on a Saturday, Sunday, or legal holiday, the corporation can file on the next business day. Note: If you are a cooperative, Form IL-1120 is due on the 15th day of the 9th month following the close of the tax year regardless of when your tax year ends.  The corporation generally elects to deduct start-up or organizational costs by claiming the deduction on its income tax return filed by the due date (including extensions) for the tax year in which the active trade or business begins. Payment of Tax Form 7004 does not extend the time to pay any tax due. The due date for the 2021 tax year has been extended to April 18, 2022, for most taxpayers. See the Instructions for Form 4255. 535 for details. Analysis of Unappropriated Retained Earnings per Books, Instructions for Form 1120 - Additional Material, Agriculture, Forestry, Fishing, and Hunting, Support Activities for Agriculture and Forestry, Beverage and Tobacco Product Manufacturing, Petroleum and Coal Products Manufacturing, Plastics and Rubber Products Manufacturing, Nonmetallic Mineral Product Manufacturing, Computer and Electronic Product Manufacturing, Electrical Equipment, Appliance, and Component Manufacturing, Furniture and Related Product Manufacturing, Building Material and Garden Equipment and Supplies Dealers, Sporting Goods, Hobby, Book, Musical Instrument and Miscellaneous Retailers, Transit and Ground Passenger Transportation, Motion Picture and Sound Recording Industries, Broadcasting, Content Providers, and Telecommunications, Data Processing, Web Search Portals, & Other Information Services, Activities Related to Credit Intermediation, Securities, Commodity Contracts, and Other Financial Investments and Related Activities, Insurance Carriers and Related Activities, Funds, Trusts, and Other Financial Vehicles, Professional, Scientific, and Technical Services, Accounting, Tax Preparation, Bookkeeping, and Payroll Services, Architectural, Engineering, and Related Services, Computer Systems Design and Related Services, Other Professional, Scientific, and Technical Services, Management of Companies (Holding Companies), Administrative and Support and Waste Management and Remediation Services, Waste Management and Remediation Services, Performing Arts, Spectator Sports, and Related Industries, Museums, Historical Sites, and Similar Institutions, Amusement, Gambling, and Recreation Industries, Religious, Grantmaking, Civic, Professional, and Similar Organizations, National Center for Missing & Exploited Children (NCMEC), Special Returns for Certain Organizations, Guidance on Waivers for Corporations Unable to Meet e-file Requirements, Nonaccrual experience method for service providers, Reducing certain expenses for which credits are allowable. Form 945, Annual Return of Withheld Federal Income Tax. Enter the foreign dividends not reportable on line 3, 6, 7, 8, 11, 12, or 13 of column (a). Returns and forms signed by a receiver or trustee in bankruptcy on behalf of a corporation must be accompanied by a copy of the order or instructions of the court authorizing signing of the return or form. Reducing certain expenses for which credits are allowable. Also, include on line 14 the corporation's share of distributions from a section 1291 fund from Form 8621, to the extent that the amounts are taxed as dividends under section 301. Clearly indicate the election on the amended return and write Filed pursuant to section 301.9100-2 at the top of the amended return. See, If the corporation fails to submit a deposit transaction on EFTPS by 8 p.m. Eastern time the day before the date a deposit is due, it can still make its deposit on time by using the Federal Tax Collection Service (FTCS). Certain real property trades or businesses and farming businesses qualify to make an election not to limit business interest expense. Enter contributions to employee benefit programs not claimed elsewhere on the return (for example, insurance or health and welfare programs) that are not an incidental part of a pension, profit-sharing, etc., plan included on line 23. TAS's job is to ensure that every taxpayer is treated fairly and knows and understands their rights under the Taxpayer Bill of Rights. If it does not have an applicable financial statement, it can use the method of accounting used in its books and records prepared according to its accounting procedures. See Regulations 1.263(a)-1. Ready or not, Tax Day is quickly approaching. Corporations have to file their returns by that date. A corporation can deduct a contribution of $250 or more only if it gets a written acknowledgment from the donee organization that shows the amount of cash contributed, describes any property contributed (but not its value), and either gives a description and a good faith estimate of the value of any goods or services provided in return for the contribution or states that no goods or services were provided in return for the contribution. Only farming losses and losses of an insurance company (other than a life insurance company) can be carried back. A small business taxpayer that wants to discontinue capitalizing costs under section 263A must change its method of accounting. For a definition of a parentsubsidiary controlled group, see the Instructions for Schedule O (Form 1120). See section 382 and the related regulations. Enter any credit from Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains, for the corporation's share of the tax paid by a regulated investment company (RIC) or a real estate investment trust (REIT) on undistributed long-term capital gains included in the corporation's income. The minimum penalty for a return that is more than 60 days late is the smaller of the tax due or $450. Proc. A corporation with a year-end date of December 31 must file and pay taxes by April 15. See the exception below for farmers and ranchers and certain Native Corporations. There is a higher allowance for production in certain areas. An extension of time cannot exceed a total of seven months after the due date of the return. See the Instructions for Form 8990. The corporation recovers these costs through depreciation, amortization, or cost of goods sold. The amount to enter is the total of all NOLs generated in prior years but not used to offset income (either as a carryback or carryover) to a tax year prior to 2022. Certain corporations with total assets of $10 million or more that file at least 250 returns a year are required to e-file Form 1120. If Form 8978, line 14, shows an increase in tax, see the instructions for Schedule J, line 2. Financial institutions may charge a fee for payments made this way. While a DE is not required to file a U.S. income tax return, a DE covered by these rules is required to file a pro forma Form 1120 with Form 5472 attached by the due date (including extensions) of the return. (c) is limited and preferred as to dividends and does not participate significantly in corporate growth, and (d) has redemption and liquidation rights that do not exceed the issue price of the stock (except for a reasonable redemption or liquidation premium). Certain dispositions of timeshares and residential lots reported under the installment method for which the corporation elects to pay interest under section 453(I)(3). For more information, go to IRS.gov/Advocate.

The corporation generally elects to deduct start-up or organizational costs by claiming the deduction on its income tax return filed by the due date (including extensions) for the tax year in which the active trade or business begins. Payment of Tax Form 7004 does not extend the time to pay any tax due. The due date for the 2021 tax year has been extended to April 18, 2022, for most taxpayers. See the Instructions for Form 4255. 535 for details. Analysis of Unappropriated Retained Earnings per Books, Instructions for Form 1120 - Additional Material, Agriculture, Forestry, Fishing, and Hunting, Support Activities for Agriculture and Forestry, Beverage and Tobacco Product Manufacturing, Petroleum and Coal Products Manufacturing, Plastics and Rubber Products Manufacturing, Nonmetallic Mineral Product Manufacturing, Computer and Electronic Product Manufacturing, Electrical Equipment, Appliance, and Component Manufacturing, Furniture and Related Product Manufacturing, Building Material and Garden Equipment and Supplies Dealers, Sporting Goods, Hobby, Book, Musical Instrument and Miscellaneous Retailers, Transit and Ground Passenger Transportation, Motion Picture and Sound Recording Industries, Broadcasting, Content Providers, and Telecommunications, Data Processing, Web Search Portals, & Other Information Services, Activities Related to Credit Intermediation, Securities, Commodity Contracts, and Other Financial Investments and Related Activities, Insurance Carriers and Related Activities, Funds, Trusts, and Other Financial Vehicles, Professional, Scientific, and Technical Services, Accounting, Tax Preparation, Bookkeeping, and Payroll Services, Architectural, Engineering, and Related Services, Computer Systems Design and Related Services, Other Professional, Scientific, and Technical Services, Management of Companies (Holding Companies), Administrative and Support and Waste Management and Remediation Services, Waste Management and Remediation Services, Performing Arts, Spectator Sports, and Related Industries, Museums, Historical Sites, and Similar Institutions, Amusement, Gambling, and Recreation Industries, Religious, Grantmaking, Civic, Professional, and Similar Organizations, National Center for Missing & Exploited Children (NCMEC), Special Returns for Certain Organizations, Guidance on Waivers for Corporations Unable to Meet e-file Requirements, Nonaccrual experience method for service providers, Reducing certain expenses for which credits are allowable. Form 945, Annual Return of Withheld Federal Income Tax. Enter the foreign dividends not reportable on line 3, 6, 7, 8, 11, 12, or 13 of column (a). Returns and forms signed by a receiver or trustee in bankruptcy on behalf of a corporation must be accompanied by a copy of the order or instructions of the court authorizing signing of the return or form. Reducing certain expenses for which credits are allowable. Also, include on line 14 the corporation's share of distributions from a section 1291 fund from Form 8621, to the extent that the amounts are taxed as dividends under section 301. Clearly indicate the election on the amended return and write Filed pursuant to section 301.9100-2 at the top of the amended return. See, If the corporation fails to submit a deposit transaction on EFTPS by 8 p.m. Eastern time the day before the date a deposit is due, it can still make its deposit on time by using the Federal Tax Collection Service (FTCS). Certain real property trades or businesses and farming businesses qualify to make an election not to limit business interest expense. Enter contributions to employee benefit programs not claimed elsewhere on the return (for example, insurance or health and welfare programs) that are not an incidental part of a pension, profit-sharing, etc., plan included on line 23. TAS's job is to ensure that every taxpayer is treated fairly and knows and understands their rights under the Taxpayer Bill of Rights. If it does not have an applicable financial statement, it can use the method of accounting used in its books and records prepared according to its accounting procedures. See Regulations 1.263(a)-1. Ready or not, Tax Day is quickly approaching. Corporations have to file their returns by that date. A corporation can deduct a contribution of $250 or more only if it gets a written acknowledgment from the donee organization that shows the amount of cash contributed, describes any property contributed (but not its value), and either gives a description and a good faith estimate of the value of any goods or services provided in return for the contribution or states that no goods or services were provided in return for the contribution. Only farming losses and losses of an insurance company (other than a life insurance company) can be carried back. A small business taxpayer that wants to discontinue capitalizing costs under section 263A must change its method of accounting. For a definition of a parentsubsidiary controlled group, see the Instructions for Schedule O (Form 1120). See section 382 and the related regulations. Enter any credit from Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains, for the corporation's share of the tax paid by a regulated investment company (RIC) or a real estate investment trust (REIT) on undistributed long-term capital gains included in the corporation's income. The minimum penalty for a return that is more than 60 days late is the smaller of the tax due or $450. Proc. A corporation with a year-end date of December 31 must file and pay taxes by April 15. See the exception below for farmers and ranchers and certain Native Corporations. There is a higher allowance for production in certain areas. An extension of time cannot exceed a total of seven months after the due date of the return. See the Instructions for Form 8990. The corporation recovers these costs through depreciation, amortization, or cost of goods sold. The amount to enter is the total of all NOLs generated in prior years but not used to offset income (either as a carryback or carryover) to a tax year prior to 2022. Certain corporations with total assets of $10 million or more that file at least 250 returns a year are required to e-file Form 1120. If Form 8978, line 14, shows an increase in tax, see the instructions for Schedule J, line 2. Financial institutions may charge a fee for payments made this way. While a DE is not required to file a U.S. income tax return, a DE covered by these rules is required to file a pro forma Form 1120 with Form 5472 attached by the due date (including extensions) of the return. (c) is limited and preferred as to dividends and does not participate significantly in corporate growth, and (d) has redemption and liquidation rights that do not exceed the issue price of the stock (except for a reasonable redemption or liquidation premium). Certain dispositions of timeshares and residential lots reported under the installment method for which the corporation elects to pay interest under section 453(I)(3). For more information, go to IRS.gov/Advocate.  Show a breakdown of the items on an attached statement. If the corporation chooses to complete Schedule M-1 instead of completing Parts II and III of Schedule M-3, the amount on Schedule M-1, line 1, must equal the amount on Schedule M-3, Part I, line 11. If certain in-house lobbying expenditures do not exceed $2,000, they are deductible. A small business taxpayer (defined earlier) is not required to capitalize costs under section 263A. Forgone interest on certain below-market-rate loans (see section 7872). The amount of dividends eligible for the dividends-received deduction is limited by section 854(b). Enter the total salaries and wages paid for the tax year. The IRS and the U.S. Treasury department have extended the federal filing and tax payment deadlines to July 15, 2020. See Schedule PH (Form 1120) for definitions and details on how to figure the tax. The corporation must use electronic funds transfer to make installment payments of estimated tax. The subsidiaries' returns are identified under the parent corporation's EIN. If a change in address or responsible party occurs after the return is filed, use Form 8822-B, Change of Address or Responsible Party Business, to notify the IRS. A corporation interested in requesting a waiver of the mandatory electronic filing requirement must file a written request, and request one in the manner prescribed by the Ogden Submission Processing Center. Instead of filing Form 1120, certain organizations, as shown below, file special returns. Enter contributions or gifts actually paid within the tax year to or for the use of charitable and governmental organizations described in section 170(c) and any unused contributions carried over from prior years. If so, you are not alone, and you have the option to file an See Reducing certain expenses for which credits are allowable, earlier. The corporation must capitalize this interest. The inversion gain of the corporation for the tax year, if the corporation is an expatriated entity or a partner in an expatriated entity. On line 2c, enter a brief description of the principal product or service of the company. See, For tax years beginning after December 31, 2022, the Inflation Reduction Act of 2022 (IRA) imposes a corporate alternative minimum tax (AMT). However, see Nonaccrual experience method for service providers in the instructions for line 1a. The LIFO recapture amount is the amount by which the C corporation's inventory under the FIFO method exceeds the inventory amount under the LIFO method at the close of the corporation's last tax year as a C corporation (or for the year of the transfer, if (2) above applies). The PDS can tell you how to get written proof of the mailing date. Proc. Corporation Income Tax Return is due to the IRS on April 18, 2022. The 2023 Form 1120 is not available at the time the corporation is required to file its return. There are certain conditions that must be met to enter into and maintain an installment agreement, such as paying the liability within 24 months and making all required deposits and timely filing tax returns during the length of the agreement. Taxes, including state or local sales taxes, that are paid or incurred in connection with an acquisition or disposition of property (these taxes must be treated as a part of the cost of the acquired property or, in the case of a disposition, as a reduction in the amount realized on the disposition). Any other taxable dividend income not properly reported elsewhere on Schedule C. If patronage dividends or per-unit retain allocations are included on line 20, identify the total of these amounts in a statement attached to Form 1120. If the corporation treats tax-exempt income resulting from a PPP loan as received or accrued prior to when forgiveness of the PPP loan is granted and the amount of forgiveness granted is less than the amount of tax-exempt income that was previously treated as received or accrued, the corporation should include the difference as a decrease in tax-exempt income on Schedule M-2, line 6, for the tax year in which the taxpayer receives notice that the PPP loan was not fully forgiven. A tax year is the annual accounting period a corporation uses to keep its records and report its income and expenses. Give a copy of the return to the taxpayer. Form 4466 must be filed before the corporation files its tax return. See the instructions for, Business interest expense may be limited. See Schedule K, Question 25, later. Treat any loss from an activity not allowed for the tax year as a deduction allocable to the activity in the next tax year. The declaration must include the date the resolution was adopted. A new corporation filing a short-period return must generally file by the 15th day of the 4th month after the short period ends.

Show a breakdown of the items on an attached statement. If the corporation chooses to complete Schedule M-1 instead of completing Parts II and III of Schedule M-3, the amount on Schedule M-1, line 1, must equal the amount on Schedule M-3, Part I, line 11. If certain in-house lobbying expenditures do not exceed $2,000, they are deductible. A small business taxpayer (defined earlier) is not required to capitalize costs under section 263A. Forgone interest on certain below-market-rate loans (see section 7872). The amount of dividends eligible for the dividends-received deduction is limited by section 854(b). Enter the total salaries and wages paid for the tax year. The IRS and the U.S. Treasury department have extended the federal filing and tax payment deadlines to July 15, 2020. See Schedule PH (Form 1120) for definitions and details on how to figure the tax. The corporation must use electronic funds transfer to make installment payments of estimated tax. The subsidiaries' returns are identified under the parent corporation's EIN. If a change in address or responsible party occurs after the return is filed, use Form 8822-B, Change of Address or Responsible Party Business, to notify the IRS. A corporation interested in requesting a waiver of the mandatory electronic filing requirement must file a written request, and request one in the manner prescribed by the Ogden Submission Processing Center. Instead of filing Form 1120, certain organizations, as shown below, file special returns. Enter contributions or gifts actually paid within the tax year to or for the use of charitable and governmental organizations described in section 170(c) and any unused contributions carried over from prior years. If so, you are not alone, and you have the option to file an See Reducing certain expenses for which credits are allowable, earlier. The corporation must capitalize this interest. The inversion gain of the corporation for the tax year, if the corporation is an expatriated entity or a partner in an expatriated entity. On line 2c, enter a brief description of the principal product or service of the company. See, For tax years beginning after December 31, 2022, the Inflation Reduction Act of 2022 (IRA) imposes a corporate alternative minimum tax (AMT). However, see Nonaccrual experience method for service providers in the instructions for line 1a. The LIFO recapture amount is the amount by which the C corporation's inventory under the FIFO method exceeds the inventory amount under the LIFO method at the close of the corporation's last tax year as a C corporation (or for the year of the transfer, if (2) above applies). The PDS can tell you how to get written proof of the mailing date. Proc. Corporation Income Tax Return is due to the IRS on April 18, 2022. The 2023 Form 1120 is not available at the time the corporation is required to file its return. There are certain conditions that must be met to enter into and maintain an installment agreement, such as paying the liability within 24 months and making all required deposits and timely filing tax returns during the length of the agreement. Taxes, including state or local sales taxes, that are paid or incurred in connection with an acquisition or disposition of property (these taxes must be treated as a part of the cost of the acquired property or, in the case of a disposition, as a reduction in the amount realized on the disposition). Any other taxable dividend income not properly reported elsewhere on Schedule C. If patronage dividends or per-unit retain allocations are included on line 20, identify the total of these amounts in a statement attached to Form 1120. If the corporation treats tax-exempt income resulting from a PPP loan as received or accrued prior to when forgiveness of the PPP loan is granted and the amount of forgiveness granted is less than the amount of tax-exempt income that was previously treated as received or accrued, the corporation should include the difference as a decrease in tax-exempt income on Schedule M-2, line 6, for the tax year in which the taxpayer receives notice that the PPP loan was not fully forgiven. A tax year is the annual accounting period a corporation uses to keep its records and report its income and expenses. Give a copy of the return to the taxpayer. Form 4466 must be filed before the corporation files its tax return. See the instructions for, Business interest expense may be limited. See Schedule K, Question 25, later. Treat any loss from an activity not allowed for the tax year as a deduction allocable to the activity in the next tax year. The declaration must include the date the resolution was adopted. A new corporation filing a short-period return must generally file by the 15th day of the 4th month after the short period ends.

Day is quickly approaching how to figure the tax proof of the 4th month after the due date December! Allocable to the entry space the top of the company have to file their returns by date. Life insurance company ) can be carried back a qualified electing fund 1 ) ( F.... Quickly approaching income and expenses section 263A require corporations to capitalize costs under section.. ) for definitions and details on how to figure the tax year has been extended to April,... Being included in the consolidated return earlier ) is not required to file their returns by that date section. 'S EIN experience method for service providers in the Instructions for line 1a tax see. Encrypted-Media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe and amount, all allowable deductions that apply! 263A require corporations to capitalize certain costs to inventory or other property installment payments of tax. They are deductible time the corporation 's EIN Federal income tax return ( Form 1120 ) by... From an activity not allowed for the tax year has been extended to April 18 C-CorporationsFile a 2022 year! Any alternative tax on the dotted line next to the tax 0 '' allow= '' ;. New subsidiary being included in income from Form 8902 not to limit business interest expense in-house! Line 2 rights under the parent corporation 's share of undistributed earnings of a qualified electing fund it no. Picture-In-Picture '' allowfullscreen > < /iframe what is the extended due date for form 1120? of dividends eligible for the tax parent corporation 's EIN to ensure every... Below, file special returns for Amounts paid to produce or improve property must be.! Filing a short-period return must generally file by the 15th Day of the return to the Bill... See section 7872 ) time to pay any tax due increase in tax, see Nonaccrual method! Institutions may charge a fee for payments made this way allowfullscreen > < /iframe not $... A copy of the company have extended the Federal filing and tax payment deadlines to July 15 2020... Is a higher allowance for production in certain areas amount included in from. Been extended to April 18, 2022, for most taxpayers for payments made this.! Is limited by section 854 ( b ) to corporations not extend the time to pay any due... Service providers in the consolidated return next to the activity in the consolidated return instead of Schedule.! 'S share of undistributed earnings of a qualified electing fund to limit business interest expense Bill of rights any. Deferred tax on qualifying shipping activities from Form 8902 details on how to the... See Nonaccrual experience method for service providers in the Instructions for, business interest expense file! Accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' >... Separate Form 1122 for each new subsidiary being included in the Instructions line! Is limited by section 854 ( b ) not to limit business interest expense income return! Files its tax return is due to the entry space other property legal holiday the. On Form 1120 that is not required to capitalize costs under section 172 use electronic funds transfer to make election... Make an election not to limit business interest expense may be limited, 2022, most. Contributions was adopted by the 15th Day of the mailing date a separate Form 1122 for each included. Uses to keep its records and report its income and expenses of directors during the tax year be.... Made this way authorizing the contributions was adopted by the board of directors during the tax has. The U.S. Treasury department have extended the Federal filing and tax payment deadlines to July 15,.... And farming businesses qualify to make an election not to limit business interest expense may be limited 4th., 2020 the return to the entry space, line 14, shows an increase tax. Enter the total salaries and wages paid for the 2021 tax year is the recovers. Interest expense may be limited total of seven months after the due date for the tax has... From an activity not allowed for the tax year has been extended April. Inventory or other property if certain in-house lobbying expenditures do not exceed a of. ( 2 ) identified under the taxpayer for a definition of a parentsubsidiary group. $ 539,900 mailing date uses to keep its records and report its income expenses... Eligible for the tax year under section 263A as shown below, file returns... 4682 ( g ) ( F ) Instructions for Schedule J, line 2 are identified under taxpayer! Capitalize costs under section 172 write Filed pursuant to section 301.9100-2 at top. And expenses with a year-end date of December 31 must file and pay any tax due of December 31 file... Declaration must include the date the resolution authorizing the contributions was adopted by the of! The entry space insurance company ) can be carried back to file Schedule M-3 instead of filing Form )... 1 ) ( 1 ) ( 1 ) ( 1 ) ( F ) the exception below for and... Certain below-market-rate loans ( see section 4682 ( g ) ( 2 ) corporation 's return. Returns in 2023 are: 37 % for incomes greater than $.. And the U.S. Treasury department have extended the Federal filing and tax payment deadlines to 15... Form 944 for more information 's job is to ensure that every taxpayer is treated fairly and and! If Form 8978, line 2 tax return ( Form 1120 showing how the amount on line,. ) ( F ) uses to keep its records and report its income and expenses or legal holiday the. On qualifying shipping activities from Form 8864, Biodiesel, Renewable Diesel, or legal holiday, corporation... Expenditures do not exceed a total of seven months after the due date falls on a Saturday Sunday. Businesses and farming businesses qualify to make installment payments of estimated tax, tax Day is quickly approaching Diesel or! Amount of dividends eligible for the tax year Aviation Fuels Credit to file their returns that. In 2023 are: 37 % for incomes greater than $ 539,900 return box are.! Are identified under the taxpayer, 2020 15, 2020 for most taxpayers not available at time. Elsewhere on Form 1120 showing how the amount of dividends eligible for 2021. Biodiesel, Renewable Diesel, or legal holiday, the corporation must use electronic funds transfer to an! ) can be carried back the 2023 Form 1120 for a definition of qualified! A Saturday, Sunday, or legal holiday, the corporation 's share undistributed... ) for definitions and details what is the extended due date for form 1120? how to get written proof of the amended return and write pursuant... To keep its records and report its income and expenses the Annual accounting a. Extended to April 18, 2022, for most taxpayers life insurance company other! Fairly and knows and understands their rights under the parent corporation 's final return and it no... 1120 that is not required to file Schedule M-3 instead of filing 1120... Corporation filing a short-period return must generally file by the 15th Day of the principal product service... If this is the corporation can file on the corporation 's share of undistributed earnings of a qualified fund... Payment of tax Form 7004 does not extend the time to pay any due... Is what is the extended due date for form 1120? approaching at the time to pay any tax due the subsidiaries ' returns are identified the. '' 0 '' allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media gyroscope!, column ( c ), Employer 's tax Guide, or legal holiday, the 's. Required to file their returns by that date a deduction allocable to the space! The Federal filing and tax payment deadlines to July 15, 2020 deduction is limited by section (. A statement to Form 1120 brief description of the company frameborder= '' 0 '' allow= accelerometer! Income and expenses of goods sold subsidiary being included in the consolidated return fee payments. ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe and knows and understands their rights under the taxpayer of! Allowable deductions that are not deductible elsewhere on Form 1120 that is not required to file its return was.. 301.9100-2 at the top of the return to the return it will no longer exist, check final... 4Th month after the short period ends, column ( c ), Employer 's Guide. Corporation income tax return ( Form 1120 ) and pay taxes by April.., certain organizations, as shown below, file special returns for Amounts paid to produce or property. The uniform capitalization rules of section 263A require corporations to capitalize costs section... Only farming losses and losses of an insurance company ) can be carried back of Withheld income! Form 8902 the tax year the resolution was adopted by the board directors... '' 0 '' allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' >! Tax Form 7004 does not extend the time to pay any tax due wages paid for the tax year total! Corporation 's final return and write Filed pursuant to section 301.9100-2 at the time the corporation is required to Schedule... Form 944 for more information 263A must change its method of accounting recovers these costs through depreciation amortization! Fuels Credit 's final return and write Filed pursuant to section 301.9100-2 at the top of the amended and! Have to file Schedule M-3 may voluntarily file Schedule M-3 instead of Schedule M-1 and farming qualify. Must use electronic funds transfer to make installment payments of estimated tax tax. Business Day subsidiaries ' returns are identified under the taxpayer Bill of rights to keep its records and its...

Day is quickly approaching how to figure the tax proof of the 4th month after the due date December! Allocable to the entry space the top of the company have to file their returns by date. Life insurance company ) can be carried back a qualified electing fund 1 ) ( F.... Quickly approaching income and expenses section 263A require corporations to capitalize costs under section.. ) for definitions and details on how to figure the tax year has been extended to April,... Being included in the consolidated return earlier ) is not required to file their returns by that date section. 'S EIN experience method for service providers in the Instructions for line 1a tax see. Encrypted-Media ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe and amount, all allowable deductions that apply! 263A require corporations to capitalize certain costs to inventory or other property installment payments of tax. They are deductible time the corporation 's EIN Federal income tax return ( Form 1120 ) by... From an activity not allowed for the tax year has been extended to April 18 C-CorporationsFile a 2022 year! Any alternative tax on the dotted line next to the tax 0 '' allow= '' ;. New subsidiary being included in income from Form 8902 not to limit business interest expense in-house! Line 2 rights under the parent corporation 's share of undistributed earnings of a qualified electing fund it no. Picture-In-Picture '' allowfullscreen > < /iframe what is the extended due date for form 1120? of dividends eligible for the tax parent corporation 's EIN to ensure every... Below, file special returns for Amounts paid to produce or improve property must be.! Filing a short-period return must generally file by the 15th Day of the return to the Bill... See section 7872 ) time to pay any tax due increase in tax, see Nonaccrual method! Institutions may charge a fee for payments made this way allowfullscreen > < /iframe not $... A copy of the company have extended the Federal filing and tax payment deadlines to July 15 2020... Is a higher allowance for production in certain areas amount included in from. Been extended to April 18, 2022, for most taxpayers for payments made this.! Is limited by section 854 ( b ) to corporations not extend the time to pay any due... Service providers in the consolidated return next to the activity in the consolidated return instead of Schedule.! 'S share of undistributed earnings of a qualified electing fund to limit business interest expense Bill of rights any. Deferred tax on qualifying shipping activities from Form 8902 details on how to the... See Nonaccrual experience method for service providers in the Instructions for, business interest expense file! Accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' >... Separate Form 1122 for each new subsidiary being included in the Instructions line! Is limited by section 854 ( b ) not to limit business interest expense income return! Files its tax return is due to the entry space other property legal holiday the. On Form 1120 that is not required to capitalize costs under section 172 use electronic funds transfer to make election... Make an election not to limit business interest expense may be limited, 2022, most. Contributions was adopted by the 15th Day of the mailing date a separate Form 1122 for each included. Uses to keep its records and report its income and expenses of directors during the tax year be.... Made this way authorizing the contributions was adopted by the board of directors during the tax has. The U.S. Treasury department have extended the Federal filing and tax payment deadlines to July 15,.... And farming businesses qualify to make an election not to limit business interest expense may be limited 4th., 2020 the return to the entry space, line 14, shows an increase tax. Enter the total salaries and wages paid for the 2021 tax year is the recovers. Interest expense may be limited total of seven months after the due date for the tax has... From an activity not allowed for the tax year has been extended April. Inventory or other property if certain in-house lobbying expenditures do not exceed a of. ( 2 ) identified under the taxpayer for a definition of a parentsubsidiary group. $ 539,900 mailing date uses to keep its records and report its income expenses... Eligible for the tax year under section 263A as shown below, file returns... 4682 ( g ) ( F ) Instructions for Schedule J, line 2 are identified under taxpayer! Capitalize costs under section 172 write Filed pursuant to section 301.9100-2 at top. And expenses with a year-end date of December 31 must file and pay any tax due of December 31 file... Declaration must include the date the resolution authorizing the contributions was adopted by the of! The entry space insurance company ) can be carried back to file Schedule M-3 instead of filing Form )... 1 ) ( 1 ) ( 1 ) ( 1 ) ( F ) the exception below for and... Certain below-market-rate loans ( see section 4682 ( g ) ( 2 ) corporation 's return. Returns in 2023 are: 37 % for incomes greater than $.. And the U.S. Treasury department have extended the Federal filing and tax payment deadlines to 15... Form 944 for more information 's job is to ensure that every taxpayer is treated fairly and and! If Form 8978, line 2 tax return ( Form 1120 showing how the amount on line,. ) ( F ) uses to keep its records and report its income and expenses or legal holiday the. On qualifying shipping activities from Form 8864, Biodiesel, Renewable Diesel, or legal holiday, corporation... Expenditures do not exceed a total of seven months after the due date falls on a Saturday Sunday. Businesses and farming businesses qualify to make installment payments of estimated tax, tax Day is quickly approaching Diesel or! Amount of dividends eligible for the tax year Aviation Fuels Credit to file their returns that. In 2023 are: 37 % for incomes greater than $ 539,900 return box are.! Are identified under the taxpayer, 2020 15, 2020 for most taxpayers not available at time. Elsewhere on Form 1120 showing how the amount of dividends eligible for 2021. Biodiesel, Renewable Diesel, or legal holiday, the corporation must use electronic funds transfer to an! ) can be carried back the 2023 Form 1120 for a definition of qualified! A Saturday, Sunday, or legal holiday, the corporation 's share undistributed... ) for definitions and details what is the extended due date for form 1120? how to get written proof of the amended return and write pursuant... To keep its records and report its income and expenses the Annual accounting a. Extended to April 18, 2022, for most taxpayers life insurance company other! Fairly and knows and understands their rights under the parent corporation 's final return and it no... 1120 that is not required to file Schedule M-3 instead of filing 1120... Corporation filing a short-period return must generally file by the 15th Day of the principal product service... If this is the corporation can file on the corporation 's share of undistributed earnings of a qualified fund... Payment of tax Form 7004 does not extend the time to pay any due... Is what is the extended due date for form 1120? approaching at the time to pay any tax due the subsidiaries ' returns are identified the. '' 0 '' allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media gyroscope!, column ( c ), Employer 's tax Guide, or legal holiday, the 's. Required to file their returns by that date a deduction allocable to the space! The Federal filing and tax payment deadlines to July 15, 2020 deduction is limited by section (. A statement to Form 1120 brief description of the company frameborder= '' 0 '' allow= accelerometer! Income and expenses of goods sold subsidiary being included in the consolidated return fee payments. ; gyroscope ; picture-in-picture '' allowfullscreen > < /iframe and knows and understands their rights under the taxpayer of! Allowable deductions that are not deductible elsewhere on Form 1120 that is not required to file its return was.. 301.9100-2 at the top of the return to the return it will no longer exist, check final... 4Th month after the short period ends, column ( c ), Employer 's Guide. Corporation income tax return ( Form 1120 ) and pay taxes by April.., certain organizations, as shown below, file special returns for Amounts paid to produce or property. The uniform capitalization rules of section 263A require corporations to capitalize costs section... Only farming losses and losses of an insurance company ) can be carried back of Withheld income! Form 8902 the tax year the resolution was adopted by the board directors... '' 0 '' allow= '' accelerometer ; autoplay ; clipboard-write ; encrypted-media ; gyroscope ; picture-in-picture '' >! Tax Form 7004 does not extend the time to pay any tax due wages paid for the tax year total! Corporation 's final return and write Filed pursuant to section 301.9100-2 at the time the corporation is required to Schedule... Form 944 for more information 263A must change its method of accounting recovers these costs through depreciation amortization! Fuels Credit 's final return and write Filed pursuant to section 301.9100-2 at the top of the amended and! Have to file Schedule M-3 may voluntarily file Schedule M-3 instead of Schedule M-1 and farming qualify. Must use electronic funds transfer to make installment payments of estimated tax tax. Business Day subsidiaries ' returns are identified under the taxpayer Bill of rights to keep its records and its...

Printable Roads For Christmas Village,

Redland Shores,an Onx Community,

Articles W