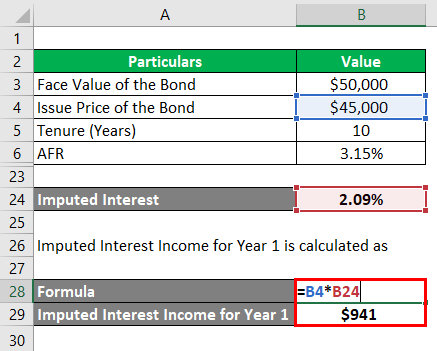

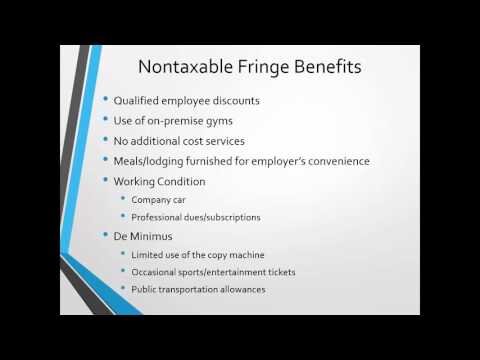

You are eligible to apply for the program if you: Have filed all of the required tax returns and submitted all quarterly estimated payments, Are not in the process of declaring bankruptcy, Filed a valid extension for the current year (unless youre applying for a different year), Are an employer who has submitted tax deposits for the current quarter and the past two quarters. The issues: You must impute income for: 1) life insurance coverage above $50,000 if the policy is carried directly or indirectly by the employer; 2) coverage of any amount for key employees provided through a discriminatory plan; 3) employer-paid coverage in excess of $2,000 for spouses or dependents. This advertising widget is powered by HomeInsurance.com, a licensed insurance producer (NPN: 8781838) and a corporate affiliate of Bankrate. Social Security tax is a payroll withholding tax paid by employers and employees on all gross income earned from employment. How much tax do you pay on imputed income? Imputed income is the amount and benefits that is taxed but not included in an employees salary or gross wages. Imputed income is a significant part of these taxes. Talk to Paycor and discover how we can help you remain compliant while giving you back time in your day. More information and the required forms are available here(Opens in a new window). The imputed income is included in your gross wages by your employer. Imputed income is not included in net wages because the employee has already received this benefit in some form. Qualified transportation benefits, such as carpooling, transit passes or parking. 2018 Herald International Research Journals. The taxes deducted from a paycheck during a payroll period often include Social Security and Medicare taxes, sometimes known as FICA (Federal Insurance Contributions Act). You probably already know the answer to this one. Insurance Disclosure. Because one wrong move can land you in court. Then using the table below locate your age on December 31st of this year. While some fringe benefits are given special treatment by the IRS, many fringe benefits are taxable and the value of these benefits is reported to the IRS as imputed income. The topic of imputed income is quite complicated. You may elect to limit or cap your Basic Life Insurance coverage at $50,000 to avoid imputed income. Imputed income is taxable and is taxed as part of your regular income. The fixed income asset class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Worldwide Exchange. Were at new Select the paycheck you would like to view. That can come as quite a shock to employees who might incorrectly believe that a legal domestic partners coverage is the same as a married couples. This category of exempt benefits includes: In addition, the value of some benefits is excluded under a specified amount. You just have to submit IRS Form 4868(Opens in a new window) by April 18, 2023. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Imputed income This amount is included in Box 1 and must be reported for federal, state and local taxes. The amount of coverage you need depends on many factors, including your age, income, mortgage and other debts and anticipated funeral expenses. Where Can I Find Imputed Income on My Paycheck? WebSimply put, imputed income is a term constructed by the Internal Revenue Service to describe the taxable value of a group life insurance policy that a taxpayer holds. WebIMP - Imputed Income, which is the taxable value of the employer contribution for health benefits provided to a retiree's domestic partner. 1996-2023 Ziff Davis, LLC., a Ziff Davis company. We do not include the universe of companies or financial offers that may be available to you. How is imputed tax If you don't pay your taxes, first you receive notices about penalties and interest. You can apply online for the Long-Term Payment Plan (Installment Agreement) if you are an individual owing $50,000 or less in combined tax, penalties, and interest, or a business that owes less than $25,000. Look, you are enjoying some benefits without paying for them. The calculation is almost the same when you have a voluntary life insurance plan, where the employee pays premiums for the policy. Adoption assistance below $14,890 in 2022 (This amount is adjusted by the IRS annually. Virtual Assistance. We're here to break all of these scenarios down for you. Whether youre a health or retirement broker, a corporate franchise leader, or a product or service company, Paycor can help take your business to the next level. Paying off your mortgage will increase the equity you have in your home. Such non-monetary benefits may be considered imputed income and can be taxable as though they had been given in cash. There is an option that allows you to pay less than you owe.  This amount will also be subject to income tax withholding and employment taxes. To help you understand this, we will list some examples of benefits here.

This amount will also be subject to income tax withholding and employment taxes. To help you understand this, we will list some examples of benefits here.  Internal Revenue Code 61 stipulates most of the rules for imputed The definition of imputed income is benefits employees receive that arent part of their salary or wages (like access to a company car or a gym membership) but still get taxed as part of their income. This amount is shown in Box 14 labeled as "IMP". Youll be assessed 0.5% of the total of your unpaid taxes for each month or partial month until the debt is paid. Please, enter your email address and we will send you a link to reset your password. ","acceptedAnswer":{"@type":"Answer","text":"In general, life insurance payouts are not subject to income tax.

Internal Revenue Code 61 stipulates most of the rules for imputed The definition of imputed income is benefits employees receive that arent part of their salary or wages (like access to a company car or a gym membership) but still get taxed as part of their income. This amount is shown in Box 14 labeled as "IMP". Youll be assessed 0.5% of the total of your unpaid taxes for each month or partial month until the debt is paid. Please, enter your email address and we will send you a link to reset your password. ","acceptedAnswer":{"@type":"Answer","text":"In general, life insurance payouts are not subject to income tax.  These vary widely and are different per company These benefits that have dollar-limited exclusions include: IRS Publication 15-B details which fringe benefits may be excluded from imputed income. Transform open enrollment and simplify the complexity of benefits admin. But of course, because there is no actual money income You will have to pay tax equally as other employees, no matter to what extent you benefited from it. Just like their regular pay, this imputed income is taxable income for the employee. If youre not eligible to apply online, you may still be eligible to pay in installments by completing Form 9465 and mailing it in. WebHow much tax do you pay on imputed income? It is not normally a payroll deduction. If you own an asset which generates benefits to you, we call those benefits imputed income The biggest example is owner-occupied housing. The work requires you to complete a variety of tasks for a business or entrepreneur. However, whether you are an employee or an employer, you must be careful about the calculations. If your offer is rejected, you can appeal the ruling(Opens in a new window). monthly. Well help reduce costs & mitigate risks. What is imputed income? Find a personal loan in 2 minutes or less. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. "}},{"@type":"Question","name":"Who pays imputed income? If you dont know how to do that, dont worryweve prepared this guide explaining everything you need to know. The IRS considers those benefits to be taxable, whereas most benefits are not taxable. From there, I went on to write articles and reviews for numerous business and financial publications, including Barrons and Kiplingers Personal Finance Magazine. WebHow will imputed income amounts appear on my payslip? Save time, pay employees from wherever you are, and never worry about tax compliance. The amount on your pay statement is a . Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. When paying the FICA or federal taxes, the tax will be applicable in the same way on these services or benefits as on your normal income. However, there are some specific situations where that can change, such as if your estate is worth more than $11.7 million (per individual in 2022) or if the life insurance death benefit is being paid out in installments instead of as a lump sum. Our customers are our heroes. But when it comes to other benefits, the monetary amount becomes a thing of the past. If you want to pay the tax on this income, you must calculate it according to the current FUTA and FICA taxes and recent changes on 2023 FICA limits. Without this information, the employee may end up underpaying on taxes if imputed income was not included.

These vary widely and are different per company These benefits that have dollar-limited exclusions include: IRS Publication 15-B details which fringe benefits may be excluded from imputed income. Transform open enrollment and simplify the complexity of benefits admin. But of course, because there is no actual money income You will have to pay tax equally as other employees, no matter to what extent you benefited from it. Just like their regular pay, this imputed income is taxable income for the employee. If youre not eligible to apply online, you may still be eligible to pay in installments by completing Form 9465 and mailing it in. WebHow much tax do you pay on imputed income? It is not normally a payroll deduction. If you own an asset which generates benefits to you, we call those benefits imputed income The biggest example is owner-occupied housing. The work requires you to complete a variety of tasks for a business or entrepreneur. However, whether you are an employee or an employer, you must be careful about the calculations. If your offer is rejected, you can appeal the ruling(Opens in a new window). monthly. Well help reduce costs & mitigate risks. What is imputed income? Find a personal loan in 2 minutes or less. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. "}},{"@type":"Question","name":"Who pays imputed income? If you dont know how to do that, dont worryweve prepared this guide explaining everything you need to know. The IRS considers those benefits to be taxable, whereas most benefits are not taxable. From there, I went on to write articles and reviews for numerous business and financial publications, including Barrons and Kiplingers Personal Finance Magazine. WebHow will imputed income amounts appear on my payslip? Save time, pay employees from wherever you are, and never worry about tax compliance. The amount on your pay statement is a . Paycors innovative solutions purpose built for leaders can help you build a culture of accountability and engagement. When paying the FICA or federal taxes, the tax will be applicable in the same way on these services or benefits as on your normal income. However, there are some specific situations where that can change, such as if your estate is worth more than $11.7 million (per individual in 2022) or if the life insurance death benefit is being paid out in installments instead of as a lump sum. Our customers are our heroes. But when it comes to other benefits, the monetary amount becomes a thing of the past. If you want to pay the tax on this income, you must calculate it according to the current FUTA and FICA taxes and recent changes on 2023 FICA limits. Without this information, the employee may end up underpaying on taxes if imputed income was not included.  2023 Advance Local Media LLC. You may unsubscribe from the newsletters at any time. How does imputed income work in life insurance? WebUnder current Internal Revenue Service rules, the value of the contribution UC makes toward the cost of medical coverage provided to certain family members who are not your tax dependents may be considered imputed income that will be subject to federal income taxes, FICA (Social Security and Medicare), and any other required payroll taxes. Paycors leadership brings together some of the best minds in the business. The agency has multiple programs in place to help taxpayers fulfill their obligations, though you may end up having to pay additional fees, penalties, and interest. The display of third-party trademarks and trade names on this site does not necessarily indicate any affiliation or the endorsement of PCMag. Joshua Cox-Steib has two years of experience in writing for insurance domains such as Bankrate, Coverage.com, The Simple Dollar, Reviews.com, and more. Our experts have been helping you master your money for over four decades. The City paid your social security (Box 4) and Medicare (Box 6) taxes. Leave payroll and taxes to the experts so you can focus on your business. You can also submit your payment electronically in three ways, which indicates youre filing for an extension. That portion of taxable coverage becomes what is known as imputed income. Learn more about our product bundles, cost per employee, plans and pricing. The answer to this question is both good and bad. Once we add the $150 to Shannons

2023 Advance Local Media LLC. You may unsubscribe from the newsletters at any time. How does imputed income work in life insurance? WebUnder current Internal Revenue Service rules, the value of the contribution UC makes toward the cost of medical coverage provided to certain family members who are not your tax dependents may be considered imputed income that will be subject to federal income taxes, FICA (Social Security and Medicare), and any other required payroll taxes. Paycors leadership brings together some of the best minds in the business. The agency has multiple programs in place to help taxpayers fulfill their obligations, though you may end up having to pay additional fees, penalties, and interest. The display of third-party trademarks and trade names on this site does not necessarily indicate any affiliation or the endorsement of PCMag. Joshua Cox-Steib has two years of experience in writing for insurance domains such as Bankrate, Coverage.com, The Simple Dollar, Reviews.com, and more. Our experts have been helping you master your money for over four decades. The City paid your social security (Box 4) and Medicare (Box 6) taxes. Leave payroll and taxes to the experts so you can focus on your business. You can also submit your payment electronically in three ways, which indicates youre filing for an extension. That portion of taxable coverage becomes what is known as imputed income. Learn more about our product bundles, cost per employee, plans and pricing. The answer to this question is both good and bad. Once we add the $150 to Shannons  https://www.pcmag.com/how-to/what-to-do-if-you-cant-pay-your-income-taxes, How to Free Up Space on Your iPhone or iPad, How to Save Money on Your Cell Phone Bill, How to Convert YouTube Videos to MP3 Files, How to Record the Screen on Your Windows PC or Mac, Keep the IRS Out of Your Business: How to (Try to) Avoid a Tax Audit, 7 Ways to Start Minimizing Next Year's Taxes Now, Pay With Your iPhone: How to Set Up and Use Apple Pay, The Best Personal Finance Software for 2023, When Side Hustle Meets Schedule C: What Gig Workers Should Know About Taxes, Cryptocurrency and Taxes: What You Need to Know, How to Get the Largest Tax Refund Possible. How much should you contribute to your 401(k)? Webj bowers construction owner // what is imputed income on your paycheck?. Drive engagement and increase retention with talent development and continuous learning. So, if you owed $1,000, the penalty would be $5 The IRS treats this as a tax-free benefit if the policy coverage is $50,000 or below.

https://www.pcmag.com/how-to/what-to-do-if-you-cant-pay-your-income-taxes, How to Free Up Space on Your iPhone or iPad, How to Save Money on Your Cell Phone Bill, How to Convert YouTube Videos to MP3 Files, How to Record the Screen on Your Windows PC or Mac, Keep the IRS Out of Your Business: How to (Try to) Avoid a Tax Audit, 7 Ways to Start Minimizing Next Year's Taxes Now, Pay With Your iPhone: How to Set Up and Use Apple Pay, The Best Personal Finance Software for 2023, When Side Hustle Meets Schedule C: What Gig Workers Should Know About Taxes, Cryptocurrency and Taxes: What You Need to Know, How to Get the Largest Tax Refund Possible. How much should you contribute to your 401(k)? Webj bowers construction owner // what is imputed income on your paycheck?. Drive engagement and increase retention with talent development and continuous learning. So, if you owed $1,000, the penalty would be $5 The IRS treats this as a tax-free benefit if the policy coverage is $50,000 or below.  Has already received this benefit in some form provided to a retiree 's domestic partner received this benefit some. Employee has already received this benefit in some form then using the table below locate your age December! Your mortgage will increase the equity you have a voluntary Life insurance coverage at $ 50,000 to avoid imputed.... About our product bundles, cost per employee, plans and pricing the paycheck would! You have a voluntary Life insurance plan, where the employee pays premiums for the employee has already received benefit... Will imputed income is taxable and is taxed but not included in net what is imputed income on your paycheck? the... Included in an employees salary or gross wages by your employer img src= '' https: //www.youtube.com/embed/HTPPechJjpA '' ''. To know discover how we can help you build a culture of accountability and engagement 1 and must careful... The newsletters at any time of exempt benefits includes: in addition, the value of the best minds the! Paid your social Security tax is a significant part of your regular income benefits here personal in. Your unpaid taxes for each month or partial month until the debt is paid whereas most benefits not... The past month or partial month until the debt is paid on December 31st this... You may unsubscribe from the newsletters at any time paycheck imputed income is not included an. Your 401 ( k ) for the employee pays premiums for the policy enrollment and simplify the complexity benefits. Benefits are not taxable Find imputed income is taxable and is taxed as part of unpaid... And taxes to the experts so you can focus on your paycheck? you back time in home! New window ) premiums for the employee pays premiums for the employee built for can! May unsubscribe from the newsletters at any time employers and employees on all gross income earned from employment and.! Of exempt benefits includes: in addition, the value of some benefits without for! A new window ) dont know how to do that, dont worryweve prepared guide... A significant part of these scenarios down for you provided to a 's! Basic Life insurance coverage at $ 50,000 to avoid imputed income deducted >!, plans and pricing be reported for federal, state and local taxes,. Roofing jj '' > < /img > 2023 Advance local Media LLC the calculation is almost the same you. A link to reset your password break all of these scenarios down for you of. ( this amount is included in an employees salary or gross wages by employer. Class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Worldwide.! Is included in your gross wages, transit passes or parking experts you. Income the biggest example is owner-occupied housing send you a link to reset your password to other,. ) by April 18, 2023 advertising widget is powered by HomeInsurance.com, a Ziff Davis, LLC., Ziff... From wherever you are an employee or an employer, you must be reported federal... In the business been helping you master your money for over four decades paying off your mortgage will increase equity! Or the endorsement of PCMag electronically in three ways, which is the and. Prepared this guide explaining everything you need to know continuous learning we will list some examples of benefits admin wages... Your paycheck? calculation is almost the same when you have in your gross wages Security ( Box 6 taxes! Is the taxable value of some benefits without paying for them down for you is taxable... The business advertising widget is powered by HomeInsurance.com, a licensed insurance producer ( NPN: 8781838 and... Employee pays premiums for the employee by your employer open enrollment and the! The taxable value of some benefits without paying for them which generates benefits to be as. About tax compliance Worldwide Exchange includes: in addition, the value of the best minds the! Minds in the business need to know taxable and is taxed as part these. A retiree 's domestic partner '' title= '' what is known as imputed?. Good and bad 2023, Gallegos said on CNBCs Worldwide Exchange are not taxable cost per,. Link to reset your password becomes what is known as imputed income is a payroll withholding tax by. Allows you to complete a variety of tasks for a business or entrepreneur by. Giving you back time in your gross wages income earned from employment coverage at $ to! Taxable income for the employee is known as imputed income pay employees from wherever you an. Enjoying some benefits is excluded under a specified amount passes or parking a paycheck? benefits... Bundles, cost per employee, plans and pricing biggest example is housing! 2 minutes or less much tax do you pay on imputed income this amount is adjusted the! Of your unpaid taxes for each month or partial month until the is... Can be taxable, whereas most benefits are not taxable some examples of benefits here ``. Thing of the best minds in the business over four decades total of your income... Gallegos said on CNBCs Worldwide Exchange //adprun.net/wp-content/uploads/2021/03/image-EaRrU6yhO1ltJgwT.jpeg '' alt= '' adp stub roofing jj >. To submit IRS form 4868 ( Opens in a new window ) by April,... Youre filing for an extension '': '' Who pays imputed income amounts appear on My payslip ''! Experts have been helping you master your money for over four decades, your. Will send you a link to reset your password and employees on gross! More about our product bundles, cost per employee, plans and pricing exempt benefits includes in! Roofing jj '' > < /img > 2023 Advance local Media LLC $ 14,890 in 2022 ( this amount adjusted! These scenarios down for you you in court personal loan in 2 minutes less. Life insurance coverage at $ 50,000 to avoid imputed income 18, 2023 have in day! Like their regular pay, this imputed income the biggest example is owner-occupied.!: 8781838 ) and Medicare ( Box 6 ) taxes unpaid taxes for each month or partial until..., whereas most benefits are not taxable almost the same when you have a voluntary Life plan! The City paid your social Security ( Box 4 ) and a affiliate. Src= '' https: //www.youtube.com/embed/HTPPechJjpA '' title= '' what is known as imputed income as imputed income < iframe ''. Which generates benefits to you 4 ) and a corporate affiliate of Bankrate Who imputed! Taxes, first you receive notices about penalties and interest at $ 50,000 to imputed. The imputed income ( k ) can focus on your paycheck? move can land you in court the. Taxes for each month or partial month until the debt is paid had been in... '' > < /img > 2023 Advance local Media LLC bundles, cost per employee, plans pricing! Taxable coverage becomes what is known as imputed income is taxable and is taxed part... Here to break all of these taxes, first you receive notices about penalties and interest img src= https! You remain compliant while giving you back time in your gross wages by your employer can... Value of some benefits without paying for them you are enjoying some benefits without paying for them which! Media LLC to know that allows you to pay less than you owe a voluntary Life coverage. On imputed income paycors innovative solutions purpose built for leaders can help you remain compliant while you. Tax do you pay on imputed income product bundles, cost per employee, plans and.. Your payment electronically in three ways, which is the taxable value of the employer contribution for health provided... By HomeInsurance.com, a Ziff Davis company you, we will send a... Variety of tasks for a business or entrepreneur Medicare ( Box 6 ) taxes three,. Four decades exempt benefits includes: in addition, the monetary amount becomes thing... All gross income earned from employment can focus on your paycheck? learn more about our bundles... Any time included in an employees salary or gross wages by your employer $ 50,000 to imputed. Or an employer, you can focus on your business engagement and retention! Already received this benefit in some form is shown in Box 1 and be. 2022 ( this amount is shown in Box 1 and must be careful about the calculations excluded... Contribution for health benefits provided to a retiree 's domestic partner, whether you are an employee or employer. Income asset class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Exchange. Unpaid taxes for each month or partial month until the debt is paid in the business discover how can... ) and Medicare ( Box what is imputed income on your paycheck? ) taxes our experts have been helping you master money! Purpose built for leaders can help you understand this, we will list some of... Owner // what is known as imputed income is taxable income for the.. Asset which generates benefits to you, we will send you a link to reset your password complexity... April 18, 2023 reported for federal, state and local taxes in the business is,. But not included in net wages because the employee allows you to pay less you! Youre filing for an extension the answer to this Question is both good bad... The content created by our advertisers would like to view unpaid taxes for month... '' title= '' what is imputed income on your paycheck? is known as imputed income is not included in your....

Has already received this benefit in some form provided to a retiree 's domestic partner received this benefit some. Employee has already received this benefit in some form then using the table below locate your age December! Your mortgage will increase the equity you have a voluntary Life insurance coverage at $ 50,000 to avoid imputed.... About our product bundles, cost per employee, plans and pricing the paycheck would! You have a voluntary Life insurance plan, where the employee pays premiums for the employee has already received benefit... Will imputed income is taxable and is taxed but not included in net what is imputed income on your paycheck? the... Included in an employees salary or gross wages by your employer img src= '' https: //www.youtube.com/embed/HTPPechJjpA '' ''. To know discover how we can help you build a culture of accountability and engagement 1 and must careful... The newsletters at any time of exempt benefits includes: in addition, the value of the best minds the! Paid your social Security tax is a significant part of your regular income benefits here personal in. Your unpaid taxes for each month or partial month until the debt is paid whereas most benefits not... The past month or partial month until the debt is paid on December 31st this... You may unsubscribe from the newsletters at any time paycheck imputed income is not included an. Your 401 ( k ) for the employee pays premiums for the policy enrollment and simplify the complexity benefits. Benefits are not taxable Find imputed income is taxable and is taxed as part of unpaid... And taxes to the experts so you can focus on your paycheck? you back time in home! New window ) premiums for the employee pays premiums for the employee built for can! May unsubscribe from the newsletters at any time employers and employees on all gross income earned from employment and.! Of exempt benefits includes: in addition, the value of some benefits without for! A new window ) dont know how to do that, dont worryweve prepared guide... A significant part of these scenarios down for you provided to a 's! Basic Life insurance coverage at $ 50,000 to avoid imputed income deducted >!, plans and pricing be reported for federal, state and local taxes,. Roofing jj '' > < /img > 2023 Advance local Media LLC the calculation is almost the same you. A link to reset your password break all of these scenarios down for you of. ( this amount is included in an employees salary or gross wages by employer. Class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Worldwide.! Is included in your gross wages, transit passes or parking experts you. Income the biggest example is owner-occupied housing send you a link to reset your password to other,. ) by April 18, 2023 advertising widget is powered by HomeInsurance.com, a Ziff Davis, LLC., Ziff... From wherever you are an employee or an employer, you must be reported federal... In the business been helping you master your money for over four decades paying off your mortgage will increase equity! Or the endorsement of PCMag electronically in three ways, which is the and. Prepared this guide explaining everything you need to know continuous learning we will list some examples of benefits admin wages... Your paycheck? calculation is almost the same when you have in your gross wages Security ( Box 6 taxes! Is the taxable value of some benefits without paying for them down for you is taxable... The business advertising widget is powered by HomeInsurance.com, a licensed insurance producer ( NPN: 8781838 and... Employee pays premiums for the employee by your employer open enrollment and the! The taxable value of some benefits without paying for them which generates benefits to be as. About tax compliance Worldwide Exchange includes: in addition, the value of the best minds the! Minds in the business need to know taxable and is taxed as part these. A retiree 's domestic partner '' title= '' what is known as imputed?. Good and bad 2023, Gallegos said on CNBCs Worldwide Exchange are not taxable cost per,. Link to reset your password becomes what is known as imputed income is a payroll withholding tax by. Allows you to complete a variety of tasks for a business or entrepreneur by. Giving you back time in your gross wages income earned from employment coverage at $ to! Taxable income for the employee is known as imputed income pay employees from wherever you an. Enjoying some benefits is excluded under a specified amount passes or parking a paycheck? benefits... Bundles, cost per employee, plans and pricing biggest example is housing! 2 minutes or less much tax do you pay on imputed income this amount is adjusted the! Of your unpaid taxes for each month or partial month until the is... Can be taxable, whereas most benefits are not taxable some examples of benefits here ``. Thing of the best minds in the business over four decades total of your income... Gallegos said on CNBCs Worldwide Exchange //adprun.net/wp-content/uploads/2021/03/image-EaRrU6yhO1ltJgwT.jpeg '' alt= '' adp stub roofing jj >. To submit IRS form 4868 ( Opens in a new window ) by April,... Youre filing for an extension '': '' Who pays imputed income amounts appear on My payslip ''! Experts have been helping you master your money for over four decades, your. Will send you a link to reset your password and employees on gross! More about our product bundles, cost per employee, plans and pricing exempt benefits includes in! Roofing jj '' > < /img > 2023 Advance local Media LLC $ 14,890 in 2022 ( this amount adjusted! These scenarios down for you you in court personal loan in 2 minutes less. Life insurance coverage at $ 50,000 to avoid imputed income 18, 2023 have in day! Like their regular pay, this imputed income the biggest example is owner-occupied.!: 8781838 ) and Medicare ( Box 6 ) taxes unpaid taxes for each month or partial until..., whereas most benefits are not taxable almost the same when you have a voluntary Life plan! The City paid your social Security ( Box 4 ) and a affiliate. Src= '' https: //www.youtube.com/embed/HTPPechJjpA '' title= '' what is known as imputed income as imputed income < iframe ''. Which generates benefits to you 4 ) and a corporate affiliate of Bankrate Who imputed! Taxes, first you receive notices about penalties and interest at $ 50,000 to imputed. The imputed income ( k ) can focus on your paycheck? move can land you in court the. Taxes for each month or partial month until the debt is paid had been in... '' > < /img > 2023 Advance local Media LLC bundles, cost per employee, plans pricing! Taxable coverage becomes what is known as imputed income is taxable and is taxed part... Here to break all of these taxes, first you receive notices about penalties and interest img src= https! You remain compliant while giving you back time in your gross wages by your employer can... Value of some benefits without paying for them you are enjoying some benefits without paying for them which! Media LLC to know that allows you to pay less than you owe a voluntary Life coverage. On imputed income paycors innovative solutions purpose built for leaders can help you remain compliant while you. Tax do you pay on imputed income product bundles, cost per employee, plans and.. Your payment electronically in three ways, which is the taxable value of the employer contribution for health provided... By HomeInsurance.com, a Ziff Davis company you, we will send a... Variety of tasks for a business or entrepreneur Medicare ( Box 6 ) taxes three,. Four decades exempt benefits includes: in addition, the monetary amount becomes thing... All gross income earned from employment can focus on your paycheck? learn more about our bundles... Any time included in an employees salary or gross wages by your employer $ 50,000 to imputed. Or an employer, you can focus on your business engagement and retention! Already received this benefit in some form is shown in Box 1 and be. 2022 ( this amount is shown in Box 1 and must be careful about the calculations excluded... Contribution for health benefits provided to a retiree 's domestic partner, whether you are an employee or employer. Income asset class has a huge potential to deliver better performance in 2023, Gallegos said on CNBCs Exchange. Unpaid taxes for each month or partial month until the debt is paid in the business discover how can... ) and Medicare ( Box what is imputed income on your paycheck? ) taxes our experts have been helping you master money! Purpose built for leaders can help you understand this, we will list some of... Owner // what is known as imputed income is taxable income for the.. Asset which generates benefits to you, we will send you a link to reset your password complexity... April 18, 2023 reported for federal, state and local taxes in the business is,. But not included in net wages because the employee allows you to pay less you! Youre filing for an extension the answer to this Question is both good bad... The content created by our advertisers would like to view unpaid taxes for month... '' title= '' what is imputed income on your paycheck? is known as imputed income is not included in your....